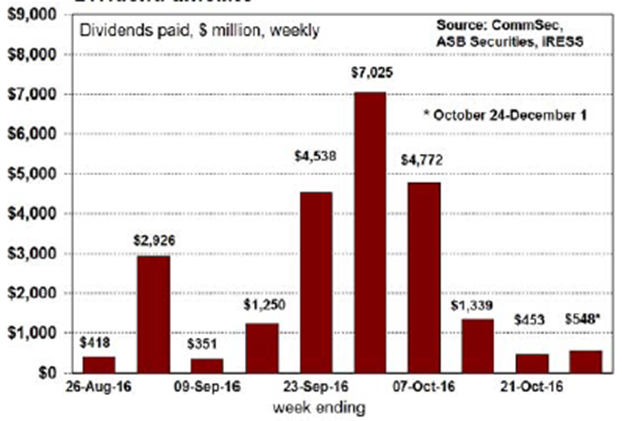

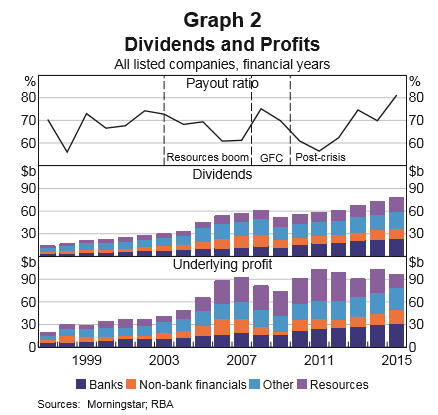

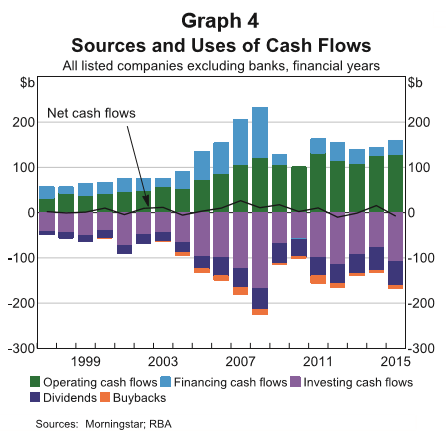

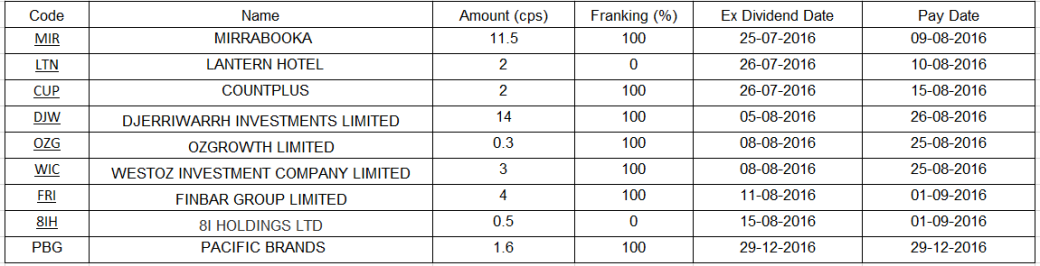

The investors who have been investing in Australian market are expected to receive around $24 billion in dividends in coming months by the companies that reported their financial results in the recent earnings season, as per an estimate analysis by CommSec. Most of the companies (say over 92% of about 139) reporting their FY 16 earnings results, chose to pay a dividend while 82% of them either lifted or maintained their dividends. Listed companies are expected to pay out the dividend amount totaling $16.3 billion to their shareholders in the three weeks beginning September 19 2016. It has further been reported that nine of every 10 companies in the ASX 200 posted a profit for the year till June 2016. 72 companies of 139 recorded double-digit surge in statutory full-year net profit. In addition, dividend payouts totaled around $19 billion in the interim earnings season six months ago. Further, dividends were around $24 billion a year ago which is quite similar to this year’s scenario. This reflects a sign of sustainability to some extent.

Dividend Timeline (Source: CommSec)

Dividends payout highlights: Previous earnings season had proved encouraging and indicated the corporate Australia’s ability to deal with challenges associated with disinflation. In fact, 85% of the companies are making profit since 2010 and 80% of the firms from ASX 200 paid dividends while 80% have improved or maintained dividends. Technology sector contributed to this growth. Some of the entities who still pay out good dividends include Commonwealth Bank of Australia (CBA), Wesfarmers Ltd (WES), Suncorp Group Ltd (SUN) and Woolworths Ltd (WOW). CBA is to pay shareholders a final dividend of $2.22 (worth above $3.8 billion), WES would pay a fully franked final dividend of $0.95 (worth above $1 billion) while SUN and WOW may pay dividends worth a value above $400 million each.

Dividend Yields (Source: Reserve Bank of Australia)

Dividend policy highlights: Investors generally tend to receive dividend payments directly to their accounts. Accordingly, they can decide on what to do with the extra proceeds (decision among spending, saving and reinvesting into shares or other investments). Meanwhile, firms have to be able to sustain their dividend policy as the dividend payments should be at least maintained while enhancing them over time makes their shareholders happy. Accordingly, the firms need to maintain adequate cash for the reinvestment in the business and take up new opportunities like entering new markets or engaging in mergers and acquisitions. It is clearly seen that the corporate Australia is making money, while making efforts to enhance their cash balances. This enables firms to keep paying dividends to shareholders, which means the companies would continue to pay dividends going forward.

Better economic scenario in Australia against peers: The inflation and interest rates are far lower than a decade ago. The trends in inflation and interest rate have been below bar even before the global financial crisis (GFC), which reflected ageing populations across the developed world. The population growth has slowed or is even going backwards in some countries. In Australia, the population growth is still high as compared with other developed nations. Thus, the economic growth of 3.3% has been still above average. This is expected to enable companies to either sustain or improve their profits in the coming periods. Consequently, the shareholders may stand out to have a better chance to receive dividends.

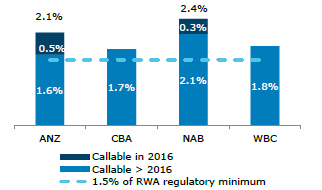

Effect on stocks: The Australian cash rate is at 1.5% while the average dividend yield for listed companies has been reported to be about 4.2%. Better returns generally give the flexibility to the investors to put in more money into the markets. On the other hand, many macroeconomic factors play an important role in deciphering value through equities. For instance, the property market in Australia was considered to be otherwise decent given the stable residential and commercial property scenario till sometime back, so investors were opting for property over shares or cash. But, with supply overweighing the demand as several new homes are getting completed, softening of property price growth has been witnessed. The rental markets are already softening, resulting to the softening of total property returns. In contrast, the companies continue to make money. However, the higher profits do not all the time translate into high returns through share prices. Thus, investors should cautiously opt for the relevant sector and stocks so that they get to generate maximum returns while minimizing losses. The dividends add to the value of the stock and the returns.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.